Written by Yanis Kharchafi

Written by Yanis KharchafiSwiss mortgage rates of 2025-2026

The line-up:

When it comes to mortgage rates, time once again heals all wounds.

While these crazy savings were truly exciting, I cannot say that I am hyped about the mortgage rates. It is just like stars in a sky red from the Thunder, you can barely see them.

Of course, Switzerland has always put obstacles in the way of those wanting to become property owners. Here, the American dream’s cost is very precise: at least 20% of the total value of the relevant property.

A major obstacle which explains why only a third of Swiss households own there housing, compared with a good half in France and, an impressive number, 3/4 in Italy.

That being said, even in the most total darkness there is always a ray of light. Be it even just a spark, that might start the most majestic of fires. This spark, is the mortgage loan.

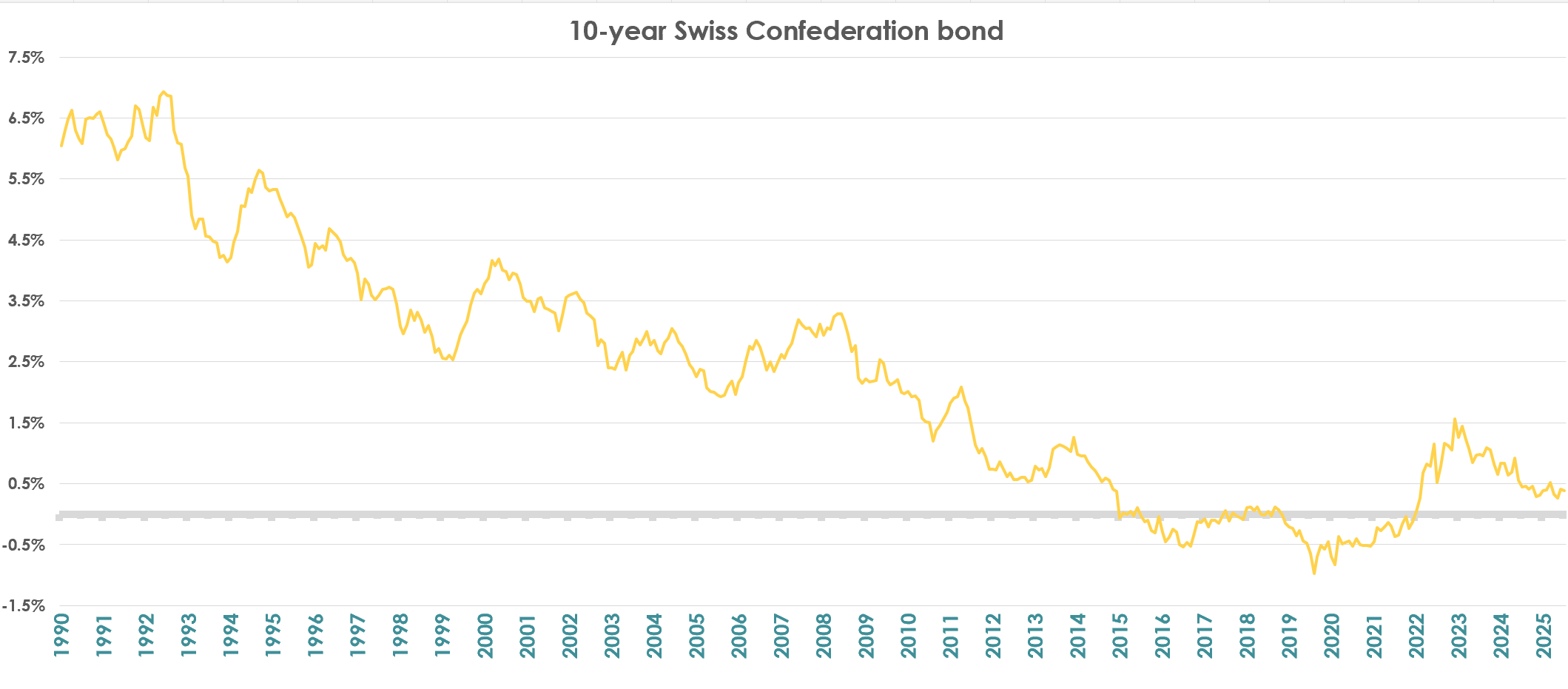

Fluctuating between one and 2% in 2020, it is at historically low rates. To put that in perspective, in December 2008, the average interest rate was 3,45%.

Fluctuating around 4% in 2008, mortgage rates experienced a spectacular drop, much to the delight of buyers and brokers, reaching historically low levels in early 2020. At that time, it was possible to secure rates at less than 1% over 10 years!

Then the period of euphoria came to an end. It was the time of rising interest rates, the end of negative rates, and a harsh return to reality for those who dreamed of becoming homeowners.

This phase lasted about two years, between 2022 and 2024, during which rates climbed from below 1% to over 2%.

Unfortunately, many of our clients and friends ended up giving in and signing their purchase agreements — perhaps a little too early… or a little too late.

Because just a few months later, 2025 arrived, and the sky began to clear again: rates started to fall, and our good old low rates made a comeback.

By the end of 2025, interest rates were once again hovering between 1% and 1.2% (not including the margins added by mortgage brokers).

Real estate market through the ages

When I started writing this article in 2020, we were at the lowest level, what more can I say? We couldn’t have asked for anything better. Rates were hovering gently between 1% and 1.5% at 10 years.

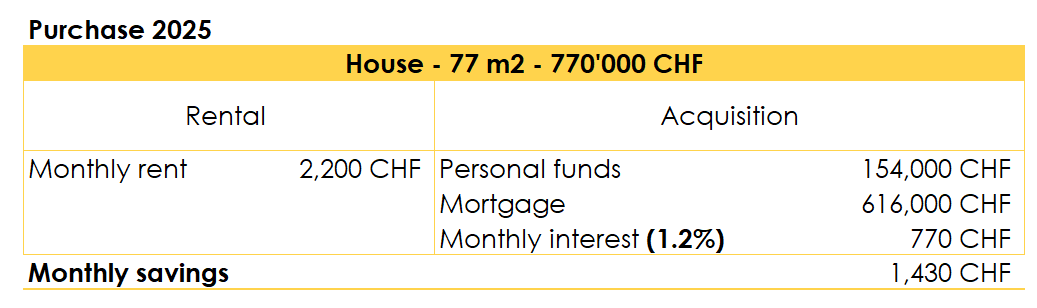

In other words, by realising my dream of buying a house for CHF 770,000 I made a gigantic saving compared to a similar rental. A handful of months later, the conclusion is dry… The entire savings have almost vanished.

But as mentioned in this introduction, the good days are back! In a turn of events as surprising as it was unexpected, mortgage rates have experienced a steep decline in recent months, bringing us almost back to historically low levels.

That said, this situation is not welcomed by everyone. Those who purchased a property before 2019 or during the rate hikes in 2022-2023 are likely feeling some frustration. For them, this drop in rates represents a significant financial loss, as they could have borrowed under much more favorable conditions today.

But as always, no one can predict the future. In real estate, as in other areas, opportunities and risks are constantly evolving.

A small clarification: In this article, and particularly in this example, we are focusing on fixed and long-term rates (10 years). However, note that this is not the only option. Borrowing rates can be fixed for much shorter periods, which, in theory, would significantly reduce the rate.

Has real estate become attractive again in 2026?

Between COVID, war, shortages, and climate concerns… the past few years haven’t exactly been smooth sailing. When things don’t go smoothly, there are bottlenecks, and in real estate, those bottlenecks usually lead to rising interest rates.

And just like magic (although, in truth, it’s far from magic—more like a complex web of factors we still don’t fully understand), mortgage rates have dropped, returning to historically low levels. Does this mean that buying property has become an attractive option again?

Yes… on paper. But it’s crucial to remember that real estate purchases involve far more than just mortgage rates.

Other key factors to consider when buying real estate

The mortgage rate is a critical component when assessing the financial appeal of a property purchase, but it’s not the only factor to keep in mind:

Buying at the right price

This seems obvious—nobody wants to overpay. Yet, real estate is one of those fields where the true value of a property is often misunderstood.

Take the example of the Lake Geneva region:

- Property prices have been steadily rising, sometimes exceeding CHF 20,000/m², compared to just CHF 10,000/m² a few years ago.

- This discrepancy is even more striking when you consider that salaries have either stagnated or increased at a much slower pace.

Conclusion: While interest rates are important, buying at a fair price is even more crucial.

Borrowing for the right term

When rates are low, many opt for long-term mortgage contracts: 10, 15 years, or even longer. The idea is appealing because it ensures stability.

However, life is full of surprises—divorce, relocation, or new opportunities. Breaking a contract prematurely can lead to significant financial penalties. It’s essential to choose a loan term that offers some flexibility.

The bank’s property valuation

Each bank has its own way of appraising a property’s value, based on internal criteria, its commercial strategy, and the market segment it aims to target.

This valuation directly impacts:

- The amount the bank is willing to lend.

- The terms of the mortgage loan.

Tip: Compare offers from multiple institutions, as your real estate project might be assessed very differently from one bank to another.

Conclusion

A low mortgage rate is a great start, but it’s not enough to ensure a successful purchase. Considering the fair price, the loan term, and the bank’s valuation is essential to avoid unpleasant surprises.

Financial institutions: important differences

A year ago I wrote here: “time seems to be doing things right concerning mortgage rates” now I prefer saying back to square one. But here are some tips on how you can lower your mortgage rate and generally improve your mortgage:

- Compare mortgage offers: Always ask at least for two different offers and try not to follow blindly the good advice of your private consultant.

- Mortgage volumes: It is likely that over the course of the same year, a bank run insurance meets its mortgage volume objectives and therefore increases the rates on purpose in order to reduce demand.

- Try to build a solid file: buying real estate property is similar to a rental request, the more the bank will feel like it can trust you, the more it is likely to grant your request and to do so advantageous terms (for the same property, different people will have different terms). Put yourself in the shoes of the person who is going to lend you the money, the more reassured you are by what you see the more likely you are to lend and potentially a larger amount. There are several ways to improve your mortgage file:

- Photos of the real estate: As crazy as it may sound, photos play an important role. The more high quality photos you have that highlight the positive points of the property, the better the overall impression will be.

- Work carried out: Providing a list of renovation work carried out in recent years to support the selling price can also help.

- Improve your solvency: If you are waiting for a bonus, a raise, a debt that is due soon, then maybe wait a bit. Every point on your file that improves will have a significant impact and could help lower your mortgage rate.

- Of the location: banks give priority to some files… It is nothing personal but they simply prefer to invest in what they consider to be promising properties or regions. Big institutions are more likely to accept properties in big cities, whereas small banks will be more interested in risks and will follow you to less central locations.

How can FBKConseils assist you with your real estate project?

An initial introduction meeting

At FBKConseils, we always offer a free first meeting in 2026.

In just 20 minutes, we take the time to learn about your project, understand your needs, and address your key questions. Book your appointment now, either via video conference or at our Lausanne office.

A comprehensive advisory session

Sometimes, 20 minutes aren’t enough to cover everything.

At FBKConseils, we offer extended sessions to dive deep into your real estate project, conduct in-depth research, and provide precise simulations tailored to your needs.

Tax and budget simulations

Short on time for calculations?

FBKConseils handles your tax and budget simulations for you. We provide a complete, detailed analysis to help you negotiate and finalize your project with confidence.

Administrative procedures

Buying real estate involves more than just calculations.

At FBKConseils, we assist you with all the administrative steps, from project evaluation to the final signing and even organizing your move.